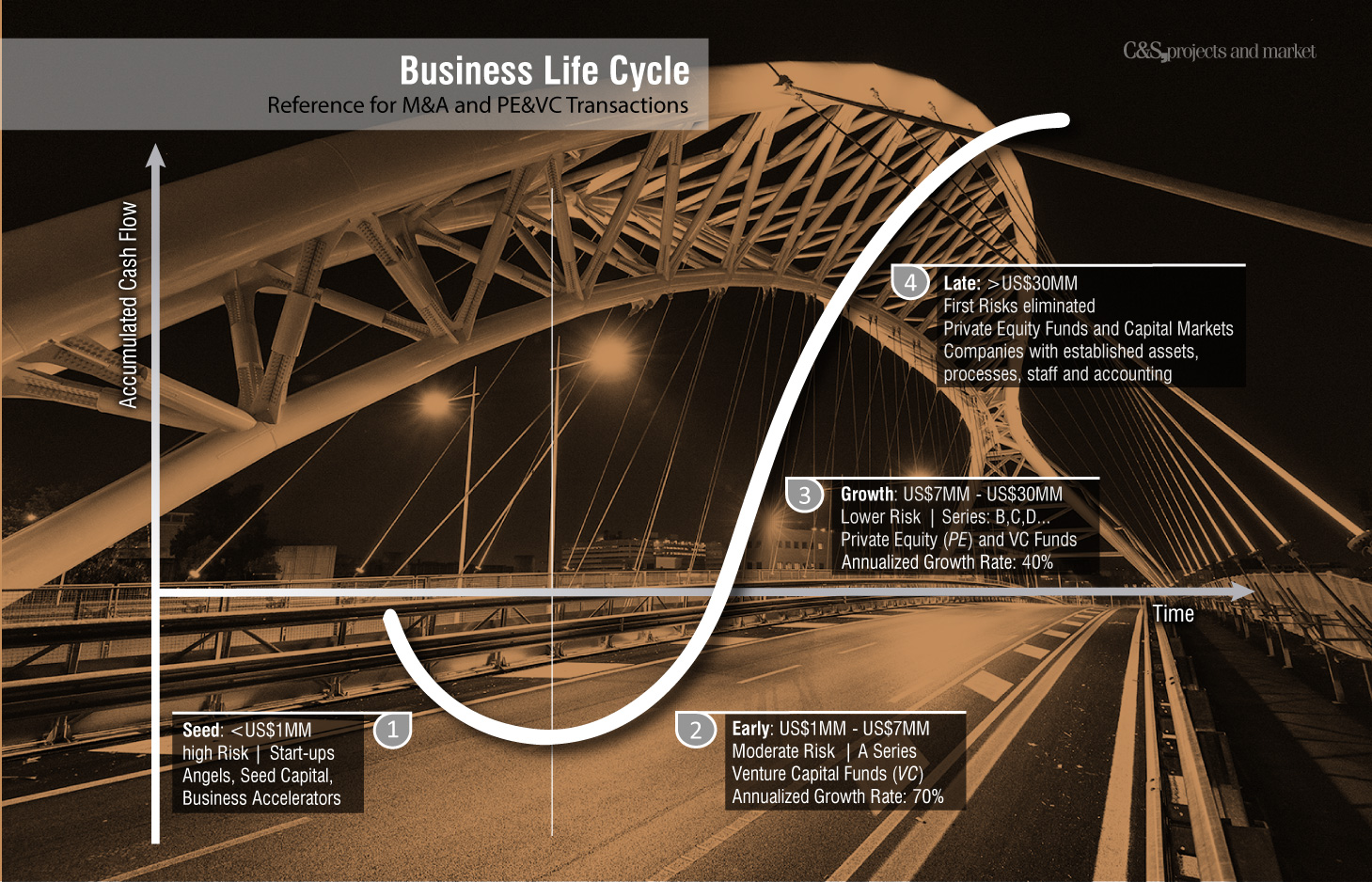

The J-Curve became a benchmark in transactions involving shareholder participation by portraying the main stages of the company’s life cycle, differentiating the companies according to the cash moment, the maturity of their processes and the risk they represent.

Thus, individual and institutional investors, when they decide to invest in the real economy, define their risk and return strategies, choosing the stage they will perform.

Understand the Stages:

1º Stage Seed:

Detail: Pre-operational, prototype or Start-ups;

Who acts: Corporate Venture Capital, Angel Investor, Capital Funds, Seed Capital, Business Incubators and Business Accelerators.

Investment: Less than US$ 1MM;

Risk: Very High.

2º Early Stage:

Detail: Operational, with Negative Accumulated Cash Flow, ‘A Series’;

Who acts: Corporate Venture Capital and Venture Capital Funds;

Investment: Between US$ 1MM and US$ 7MM;

Risk: High.

3º Growth:

Detail: High growth rates (40% per annum) – ‘B’, ‘C’ and ‘D’ Series;

Who acts: Growth Funds (in Brazil, this stage is disputed by the Private Equity and Venture Capital Funds);

Investment: Between US$ 7MM and US$ 30MM;

Risk: Moderate.

4º Late Stage:

Detail: Reached maturity level, with assets, processes and staff established;

Who acts: Private Equity Funds and Capital Markets;

Investment: Higher than US$ 30MM;

Risk: Moderate – Low (first risks eliminated).